The Inflation Reduction Act (IRA), signed into law in August 2022, is a piece of legislation aimed at addressing several critical issues facing the United States, including inflation, healthcare costs, and climate change.

Inflation Reduction Act Impact on Healthcare

Focusing on the healthcare industry, the IRA includes provisions designed to lower the cost of prescription drugs, make healthcare more affordable for Americans, and reduce the federal deficit. For the pharmaceutical, biotech, and medtech industries, the IRA introduces significant changes to how drug prices are negotiated, reimbursed, and regulated, particularly under the Medicare program. This legislation marks a major shift in federal healthcare policy with the potential to impact drug pricing, market access, and the future landscape of medical innovation.

Change 1: Direct Negotiations Under the Inflation Reduction Act

Before the IRA, under Medicare Part D, Medicare contracts with private plan sponsors to provide prescription drug benefits. The “non-interference” clause in the law prevents the Secretary of Health and Human Services (HHS) from interfering in negotiations between drug manufacturers and pharmacies and from setting reimbursement prices for Part B and Part D drugs. As a result, the federal government had limited ability to negotiate lower prices for drugs.

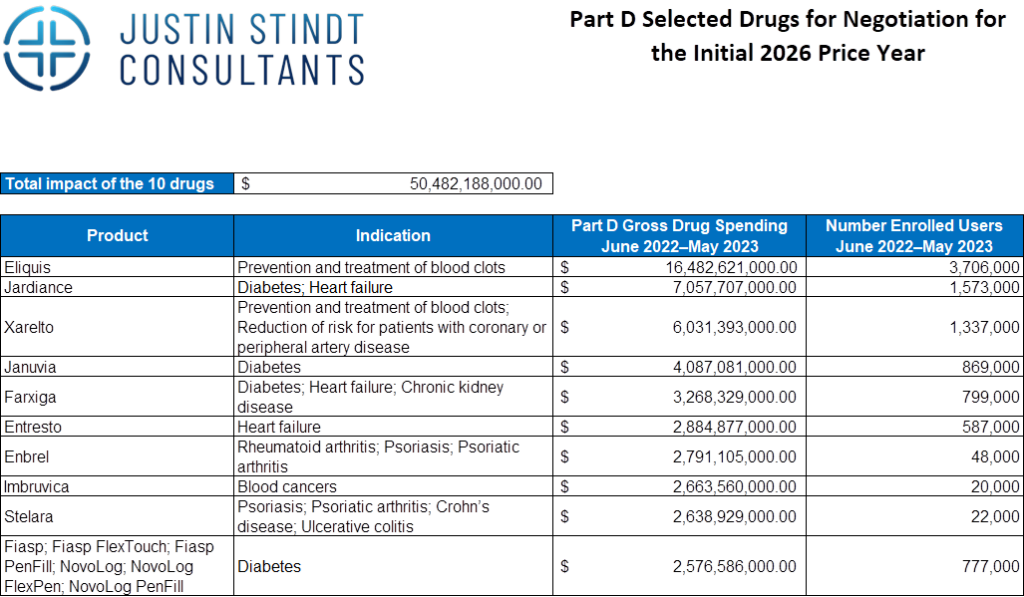

The IRA amended the Non-Interference Clause, authorising Medicare to negotiate drug prices directly with pharma and biotech firms. To be eligible for negotiation, drugs must be among the top of the list in terms of Medicare expenditure, lack generic or biosimilar alternatives, and have been approved by the FDA for at least 7 years for drug products and 11 years for biologics. The process will start with 10 Part D drugs in 2026 (see table below), 15 more in 2027, and expanding to Part B drugs in 2028.

Drugs Exempt from the Negotiation Process

- Drugs with generics or biosimilars

- Drugs that are less than 7 years (for small-molecule drugs) or 11 years (for biological products) from their FDA-approval or licensure date

- Low-spend drugs

- Orphan drugs designated for only one rare disease

- Plasma-derived products

Exposure Risk to Direct Negotiations

This change will disproportionately affect drugs that cost Medicare the most and small-molecule drugs. Further, medicines in treatment areas with a higher proportion of Medicare patients will face more risk to direct negotiations. For example, pediatric indications are likely going to have low exposure risk, as opposed to oncology drugs which face higher risk.

Change 2: Introduction of “Maximum Fair Prices” or Price Caps

Another change brought about by the IRA introduced a cap on the maximum negotiated price. The negotiated price will take into account R&D costs, production and distribution costs, federal financial support, market data, and the therapeutic value and effectiveness of the drug compared to alternatives. The agreed-upon negotiated prices for the drugs selected for the first round of negotiations will be published by September 1, 2024 and come into effect starting January 1, 2026.

Non-Compliant Companies Face Penalties

Pharma and biotech companies that are not compliant face an excise tax starting at 65% of product’s US sales, and increasing monthly to a maximum of 95%. Alternatively, manufacturers can decide to withdraw all products from Medicare and Medicaid coverage. Furthermore, manufacturers that refuse to offer an agreed-upon negotiated price face a civil monetary penalty.

Change 3: Drug Manufacturers to Pay Rebates for Price Increases Exceeding Inflation

The last major change the IRA made pertains to price caps. Previously, Medicare did not have the authority to limit price increases for Part B or Part D drugs. However, with the Inflation Reduction Act drug manufacturers must pay rebates if prices increase faster than the inflation rate (applicable to nearly all Part D and some Part B products).

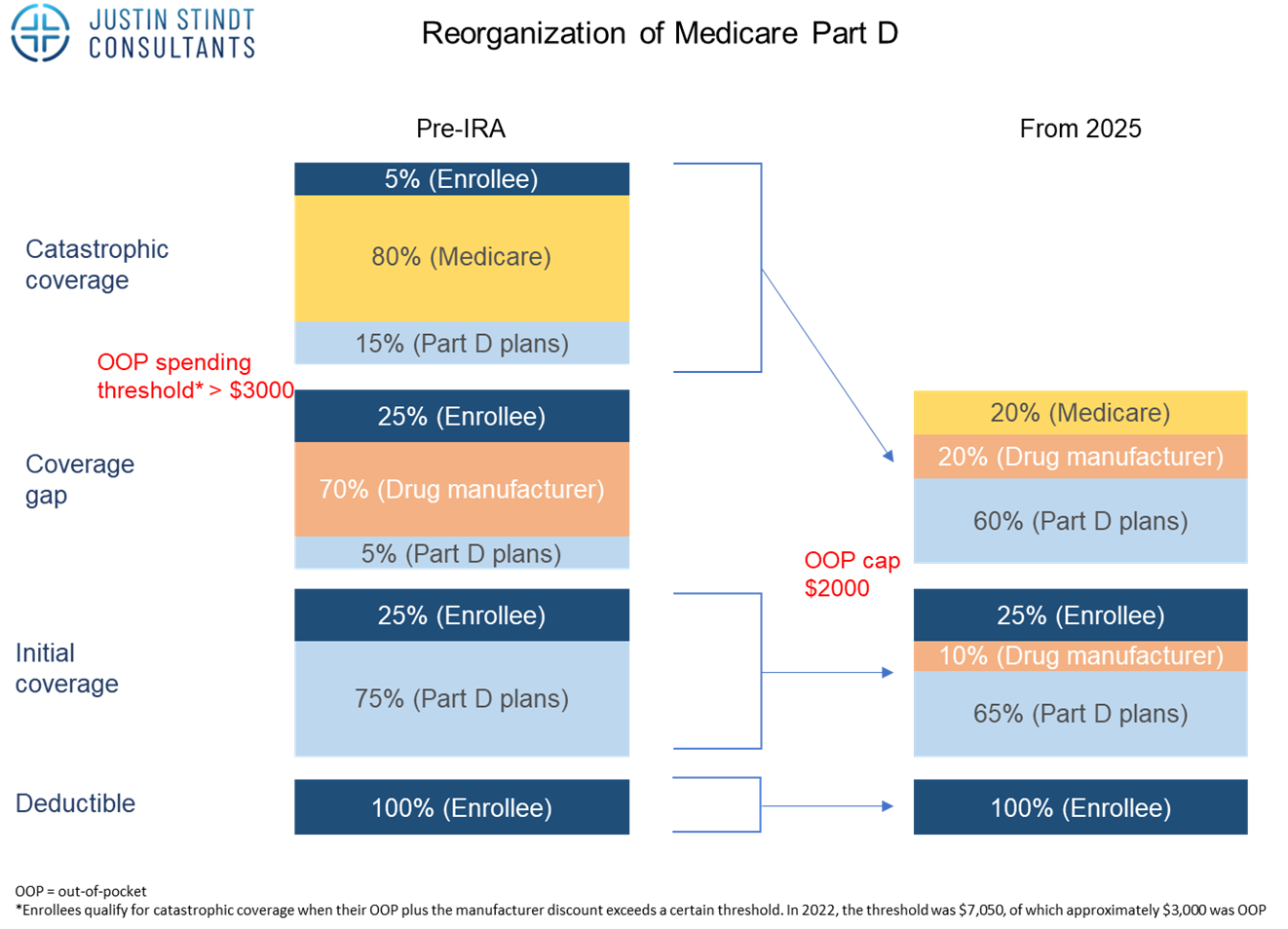

Change 4: Part D reorganization – Shift in Financial Liability from Medicare to Industry

Before the IRA part D was divided in four stages. The first stage is the deductible which is 100% covered by the enrolee, with the amount varying across different plans. Once this amount is reached, the initial coverage period begins where costs are shared between the enrollee (25%) and Part D plan (75%). This coverage period ends once what has been paid by the enrollee and the plan reaches a certain cap. The next period called the coverage gap or doughnut hole begins, where costs are shared between the enrollee (25%), manufacturer (70%) and the Part D plan (at least 5%) for branded products. For generics, Medicare will cover 75%, so in both cases the enrolee only covers 25%. This period ends if and when the amount spent from the beginning of the year hits another limit. Then, the catastrophic coverage phase starts, where enrolees pay only 5% of each prescription, while Medicare and Part D plans cover the rest (80% and 15%, respectively).

With the IRA and from 2025, the out-of-pocket cost for patients will be capped at 2,000$. The coverage gap phase is eliminated, and instead drug manufacturers will provide a 10% discount on branded drugs in the initial coverage phase (compared to 70% discount they had to provide in the coverage gap phase previously). In addition, the catastrophic phase shifts away financial liability from the patient who will no longer have to cover 5% of the costs. Rather, the drug manufacturers will now have to provide a 20% discount on brand name drugs, Part D plans’ share of costs will increase to 60% for both brand name and generic drugs, and Medicare’s participation will reduce from 80% to 20% for brand-name drugs and 40% for generic drugs.

Impact

The IRA is intended to lower prices of health care costs while supporting the development of highly innovative drugs (e.g., orphan drugs are exempt from the price negotiations). The IRA targets older but expensive drugs that have long since recovered their initial R&D costs.

Notwithstanding the positive impact the IRA will have on the American population, industry players have voiced their concerns that it will negatively influence R&D investment, post-approval R&D and early-stage products in the pipeline. For example, pharma and biotech firms may reconsider their early-stage pipeline projects, as price setting for these medicines can begin seven/eleven years after FDA approval, with the set price taking effect nine/thirteen years after approval. This is much earlier than the 13-14 years previously seen before facing generic competition.

In a Nutshell

The Inflation Reduction Act introduces substantial changes aimed at reducing drug prices and out-of-pocket costs for Medicare beneficiaries. While these changes are overall positive, they may have potential downsides for pharma and biotech players, particularly those with a high concentration of high-Medicare-spend products in their portfolio. The IRA has been criticized by industry to undermine the market based economic principles underlying the healthcare industry and to create barriers for future investment in R&D. Understanding and adapting to these changes is crucial for successful Market Access in the USA.

JSC Expertise

Justin Stindt Consultants is a specialized market access consulting firm offering bespoke market access services. Our team of experts has extensive experience in the US Market Access, ensuring that our clients are well-prepared for seamless application submissions. Our agency has been the preferred service provider for many pharmaceutical and biotechnology companies seeking assistance with crafting the US Market Access strategy.

Stay Updated

We are closely tracking all US news and changes relevant to our pharma, biotech and medtech clients. For more detailed insights and updates, visit our blog regularly.

Why Choose Us?

- Proven Expertise: With years of experience in global pricing and reimbursement, our team offers unparalleled expertise and strategic insights.

- Tailored Solutions: We understand that each client and market is unique, and we provide customized solutions that address specific needs and challenges.

- Comprehensive Support: From initial strategic advice to implementation and beyond, we offer end-to-end support to ensure your success.

- Regulatory Mastery: Our deep understanding of regulations, requirements and processes, including extensive experience with the FDA and American payers, positions us to effectively advocate for your products.

Partner with Justin Stindt Consultants to leverage our expertise and achieve your market access goals with confidence.

1. [source]