In the competitive and resource-constrained world of biotechnology, achieving market access and reimbursement is critical. Many biotechs target partnering or out-licensing and as a consequence some biotech companies feel that a partner or acquirer will take care of Market Access. While this may be true for some activities, there is an essential list of best practices that every biotech should invest in to reach the Market Access value inflection point and increase the chances of finding a partner. This guide outlines practical, high-impact activities for biotech companies to pave the way for sustainable market access without overextending resources. Please note this blog article is a summary of best practices and you can obtain the full report by contacting us.

Key activities for successful market access value inflection

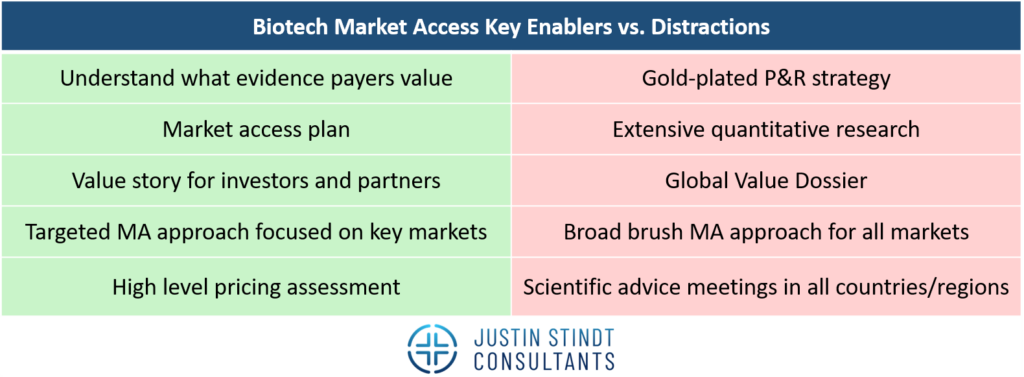

Based on Justin Stindt Consultants’ experience as an agency helping biotech firms achieve market access, following an in-depth review we found that there are a handful of key activities that are dealbreakers for success.

Understanding what evidence payers value

Biotech companies need to start with a robust understanding of the needs of all of their customers including payers, patients and prescribers. Each country evaluates medical technologies differently, often with distinct criteria that reflect their healthcare priorities. For example, Germany bases its assessments on the added benefit of a product while the United Kingdom places a strong focus on cost-effectiveness. The best biotech companies embrace this diversity in payer expectations and drive tailored evidence-generation strategies meeting the needs of different payer archetypes.

Additionally, biotechs should keep in mind there is no need for a broad brush approach targeting all possible markets but rather a targeted approach focusing on the most important markets such as the US and Germany and market archetypes, e.g. the UK as archetype of a cost-effectiveness driven market. High impact activities such as scientific advice meetings with HTA bodies to align on the pivotal trial design and payer advisory boards provide this much needed payer customer insight.

Market access plan

The development of a market access plan is another cornerstone of success. While the structure and level of detail of the plan depend on the development stage of the product, it should always provide a clear roadmap of activities. For pre-clinical technologies, a succinct one-page overview outlining key strategic goals and activities may be sufficient.

In contrast to this, for products in later stages market access planning becomes more complex and mapping out country specific market access activities, payer engagement strategies, pricing and reimbursement (P&R) scenarios, submission and negotiation timelines (not exhaustive) at least 12 to 18 months before the anticipated launch is essential. The best biotech companies regularly review and track progress on the Market Access plan.

High level pricing assessment

Successful market access and accurate pricing assumptions are vital for biotech companies and their investors and partners, as they significantly impact valuations and business development outcomes. This is particularly important for biotech companies as they require big investments pre-revenue while facing high risks, requiring regular financing rounds or a partner and out-licensing to survive.

Big pharma companies and investors place high emphasis on Market Access readiness in their due diligence review, as the opposite will result either in significant delays and additional cost (e.g. having to conduct further trials) or lack of reimbursement and/or low pricing. Biotech firms thus require at least a high-level pricing assessment to establish a general price range that is substantiated by the target product profile and aligned with payer expectations.

The best biotechs build credibility with investors and partners and increase the likelihood of a successful BD&L deal by showing realistic price assumptions based on actual payer customer feedback. Furthermore, your counterparts are usually generating this insight for themselves, so why should you deprive yourself of this information and leave money on the table because of an information asymmetry?

Value story for investors and partners

Relying heavily on external funding, biotechs at any development stage need to convince potential investors and partners that the biotech product will deliver clinical success and enable reimbursement at a sustainable price. It is standard practice to have a non-confidential company presentation and a more detailed pitch deck once a CDA has been signed. Still too many biotechs include no or just superficial information on the Pricing & Reimbursement potential, the absence of which are clearly noted by potential partners and investors.

Including a concise synthesis of both the clinical and the economic burden of disease helps to set the stage. The ability to show a price range based on initial payer feedback will impress your target audience and is industry best practice, especially if the mechanics and underlying rationale of it are clearly explained. For example, a product used in the ICU setting reducing the length of an ICU stay will have a strong economic value proposition given the high cost per day of ICU care.

What market access activities you do not need for success

In the early stages of market access planning, certain activities and deliverables that are commonly associated with pharmaceutical launches may be unnecessary for resource-constrained biotech companies.

Global value dossier

A global value dossier (GVD) is a comprehensive, often 300-500+ pages long document, containing evidence-supported value messaging related to the product. It is a time- and resource-intensive endeavour, associated with significant budget and binding internal resources even if driven by an external agency. The GVD is one example of an activity that big pharma companies targeting a global launch will typically generate but a biotech company can usually do without.

A GVD is never submitted or shown to external customers and biotech companies should focus on the customer facing submission documents instead, e.g. the US AMCP dossier and national EU P&R dossiers. Also, a 20-30 slide deck focusing on the payer value proposition and that you can draw from for payer interactions such as hearings is a powerful tool for stakeholder engagement. By streamlining the value story into a format that resonates with stakeholders, biotech companies can efficiently communicate their product’s potential while conserving resources.

Gold-plated P&R strategy and quantitative research

It is critical to understand pricing opportunities, payer willingness to pay, international reference pricing implications, and the value drivers that resonate with decision-makers. However, this does not require biotech firms to engage in exhaustive research or overly complex modelling exercises. Overly elaborate or „gold-plated“ P&R strategies often consume disproportionate resources without yielding significantly better insights during the early stages of development. Instead, a more streamlined approach is both practical and effective.

For example, conducting focused P&R research involving a handful of payers and experts per target market or organizing an advisory board can provide actionable insights. These engagements are typically sufficient to uncover market-specific pricing opportunities, identify key barriers, and gain critical early advice for the product.

Scientific advice meetings

Certain countries offer free or paid early scientific advice, where national HTA bodies provide their feedback on topics such as the clinical trial design, quality of evidence, or appropriate comparator. As outlined earlier these meetings can be very useful to align product development with HTA bodies’ expectations.

However, doing these in every single country and potentially even regional level will consume a disproportionate amount of resources and yield diminishing returns. Focusing on 2-3 archetypes for scientific advice meetings and replacing the most expensive advice meetings with an ad board with payer experts is usually more efficient.

Key inhouse activities biotechs can do to prepare for market access

Biotech companies can undertake several preparatory activities internally without the need for a consulting agency to strengthen their market access strategies with minimal budget impact. Our consulting firm outlines these activities in our full report, which you can receive by reaching out to us.

Justin Stindt Consultants can help biotech companies with Market Access

Justin Stindt Consultants is a trusted agency partner for biotech companies at all stages of development, known for its deep expertise in market access and pricing strategies. Our team of seasoned professionals brings extensive experience in biotech market access and best practices, making us a go-to consulting firm for companies navigating this complex landscape.

Reach out to our team of experts to tailor our services to your unique needs and ensure your biotech initiatives are backed by effective and impactful market access strategies.

Why choose us as your Market Access agency?

- Proven Expertise: With extensive experience in global pricing and reimbursement, our team offers unparalleled expertise and strategic insights which have received many positive reviews and customer testimonials.

- Tailored Solutions: We understand that each client and market is unique, and we provide customized solutions that address specific needs and challenges.

- Comprehensive Support: From initial strategic advice to implementation and beyond, our award-winning team offers end-to-end support to ensure your success.

- In-depth knowledge of regulations: Our agency’s deep understanding of regulations, requirements and processes, including extensive experience with HTA bodies, positions us to effectively support your products.